Table of Contents

Vietnam’s diaper industry is entering a new growth phase, driven by both rising infant care standards and the country’s aging population. With the market projected to exceed $1.58 billion by 2033, Vietnam is fast becoming one of Southeast Asia’s most dynamic destinations for diaper manufacturing, import, and distribution. For OEM brands, private label buyers, and regional distributors, the opportunity is clear: Vietnam is ready for expansion.

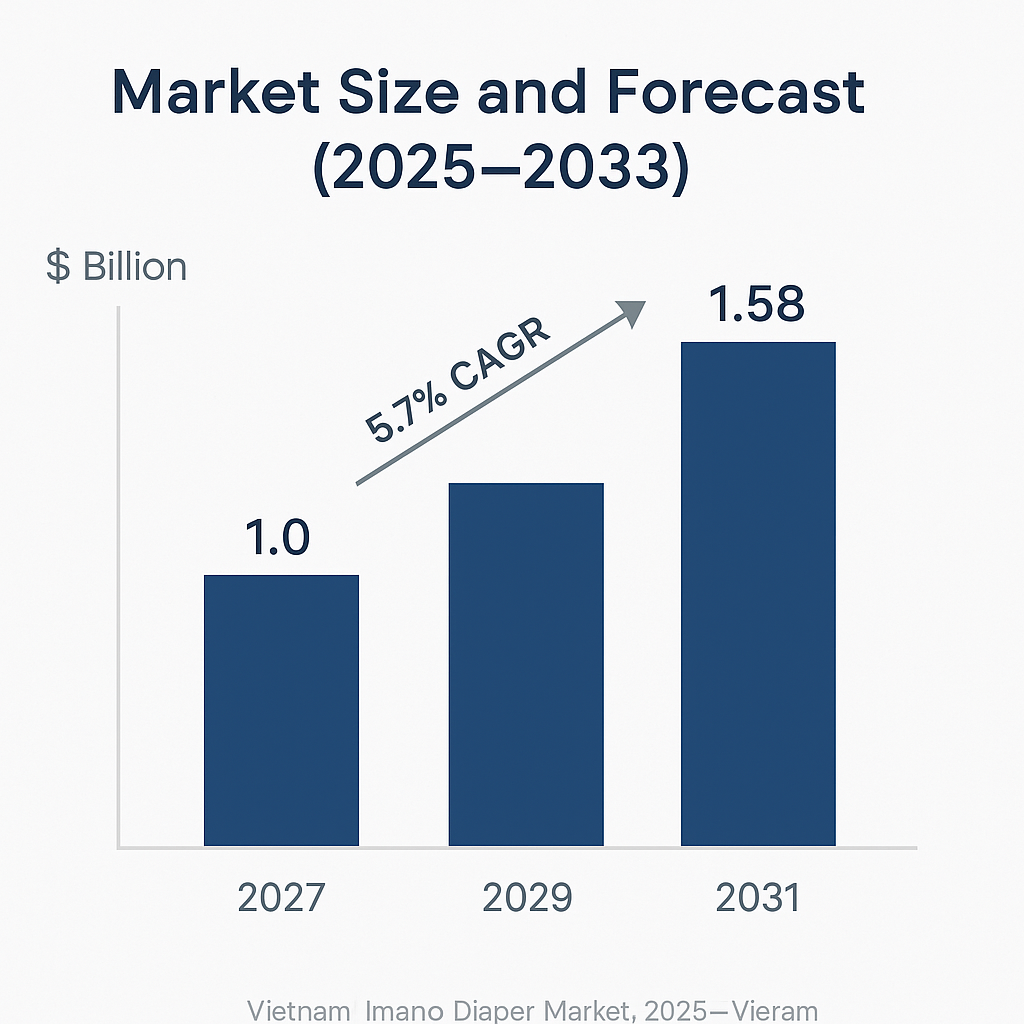

Market Size and Forecast (2025–2033)

Vietnam’s diaper market was valued at approximately $914 million in 2023. It is expected to grow at a CAGR of 5.7%, reaching $1.58 billion by 2033. Growth is being driven by:

Increasing demand for disposable baby and adult diapers

Expanding urban middle class

Greater hygiene awareness in post-pandemic households

The rise of private label and e-commerce diaper brands

Demographic Trends and Consumer Behavior

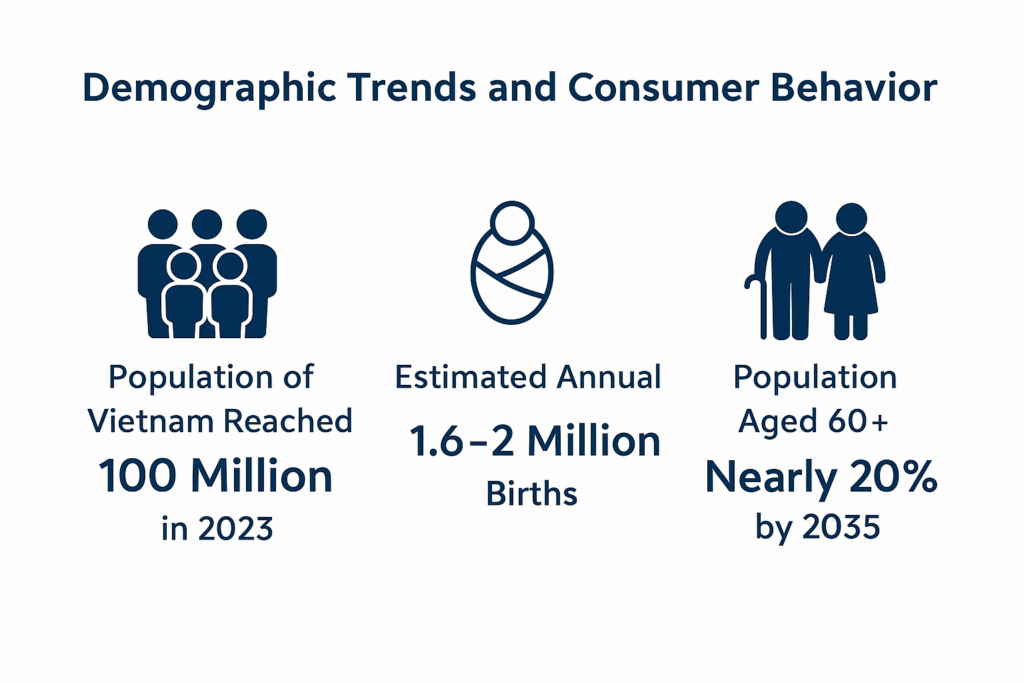

Vietnam’s population crossed the 100 million mark in 2023, according to Wikipedia.

Approximately 1.6–2 million babies are born each year, sustaining steady demand for baby diapers.

Vietnam is also an aging society—by 2035, nearly 20% of the population will be over 60, accelerating demand for adult incontinence products.

Urban parents are spending more on premium, skin-friendly, and leak-proof diapers, while elderly care homes, hospitals, and pharmacies are driving growth in adult diapers.

Demographic Trends and Consumer Behavior

Vietnam’s diaper shelves are currently dominated by global names like Huggies, MamyPoko, and Moony, as well as imported Chinese and Korean brands. However, a shift is happening:

More Vietnamese retailers are exploring OEM solutions from manufacturers in China and Southeast Asia.

Private label diaper brands are rising through online platforms like Shopee and Tiki.

Cost sensitivity and a desire for local branding are opening doors for custom, affordable diaper products.

Emerging brands like KeiAnn, supplied by professional OEM manufacturer TIANZHENG, are gaining traction due to their balance of quality, price, and local support.

Stay Updated Through Industry Exhibitions

To better understand the evolving diaper market in Vietnam, local and international exhibitions offer valuable insights. Events such as the Vietnam Maternity and Baby Fair in Ho Chi Minh City or regional hygiene product expos in Southeast Asia have become important venues for:

Discovering new diaper brands and innovations

Meeting OEM manufacturers and suppliers

Exploring consumer trends such as eco-friendly diapers or smart packaging

Networking with distributors, retailers, and brand owners

For example, the KeiAnn brand by TIANZHENG has participated in multiple exhibitions across Vietnam and Cambodia, showcasing its range of affordable, high-quality diapers to local buyers. These events not only boost brand visibility but also help manufacturers understand on-the-ground market demands.

Local Distribution and Import Trends

Vietnam imported over RMB 1.4 billion worth of diapers from China in 2023, according to GACC. This reflects a healthy demand for imported diapers, but also reveals the gap for locally distributed or co-branded OEM offerings.

Distributors are increasingly looking for:

Localized packaging and marketing

Faster shipping from nearby factories

Small-batch trial orders before large commitments

Ongoing technical and promotional support

Future Opportunities (2025–2033)

The next 10 years will bring continued growth, but also a more competitive landscape. Success in the Vietnam diaper market will depend on:

OEM flexibility – custom sizing, materials, and design

Local presence – sales reps, warehouse hubs, and language support

Eco-conscious products – biodegradable or bamboo-based diaper options

Brand support – samples, store materials, and after-sales service

Conclusion

Vietnam’s diaper market offers strong potential for B2B players—from retailers to private label brand owners and OEM buyers. The combination of demographic stability, increasing quality expectations, and digital retail growth make it one of Southeast Asia’s most promising hygiene product markets.

For manufacturers and brands with the right pricing, flexibility, and support infrastructure, Vietnam is not just a sales target—it’s a long-term strategic growth market.